New rules of KYC verification

November 16, 2021 | News

Increasing the transaction limit without KYC verification

Until now, we required KYC verification when the amount exceeded $1,000. For investments over $15,000, additional verification confirming the address of residence was also required.

The new verification guidelines are much less restrictive. Currently, verification will only be required when the order or sum of orders exceeds $13,000 or with the fifth transaction regardless of the order amount.

The only condition to pass the verification will be to send a scan or photo of a document such as an ID card, passport, or driving license.

Verification takes up to 48 hours.

New KYC verification conditions:

ATTENTION! Don’t make the verification process unless it is dictated by the conditions below. It is not necessary.

- When your order or sum of orders exceeds $13,000

- When you make 5 transactions that are successfully finalized, regardless of the amount or the sum of all paid orders

KYC verification requirements:

To pass the verification, the user must provide a scan or photo of an identity document, i.e. ID card, passport, or driving license

- the image quality must be good enough for the information in the document to be read

- file format: JPG or PDF

- file size: up to 25 MB

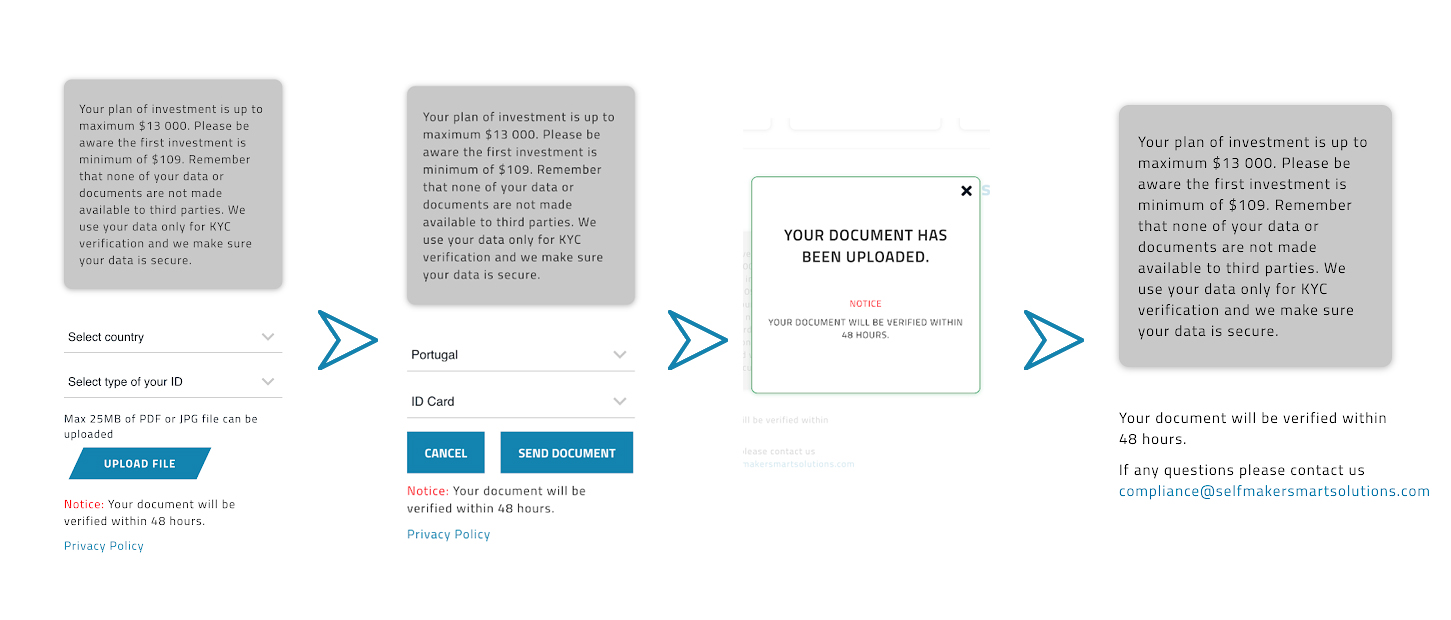

How to send the document?

There are a few steps to fulfill the process:

- go to the KYC tab in the user panel, where you will find the KYC form

- select the country of your residence from the drop-down list

- select the type of document from the drop-down list (there are only three to choose from: ID, passport, or driving license)

- click: UPLOAD FILE

- choose a file with a document from your device

- confirm choosing the file in the browser window

- confirm sending the file in the KYC panel by clicking „SEND”

- if you want to change the file or cancel verification, click the „CANCEL” button

After sending the document, you will receive the information that the verification may take up to 48 hours.